Meet Nimi Natan

He’s President & CEO of Gulf Coast Small Business Lending. While Nimi may not be your run of the mill, suit & tie banker, he loves SBA lending and especially enjoys working directly with our borrowers. Our affinity for complicated and unusual deals starts at the top and permeates our culture.

Under Nimi’s leadership we deliver SBA & USDA loans across the country, to business owners of all types, in a wide variety of industries, who are as committed to their families, businesses, and communities as we are to ours. We work closely with our borrowers and referral sources to understand their needs and tailor solutions.

We aren’t your everyday, ordinary SBA and USDA lenders.

Built to Last: What Makes a Loan Withstand the Economic Cycle?

As a follow up to my February 2026 blog post (https://gulfcoastsba.com/the-gilded-cage-the-perils-of-private-credit-for-small-businesses/), which featured an in-depth discussion of the characteristics of a “bad loan,” I would now like to talk about what makes a loan “good.” Or, more specifically, what makes a loan resilient to economic reality?

Let’s start by describing what “economic reality” really is.

- First, the immutable economic cycle. While a healthy economy is on a positive growth trajectory, it is not a straight line, but rather a wavy one with expansions and contractions, peaks and troughs. Since the ‘70s, the length of the typical cycle has been 8 years (trough to trough), well within the life of a typical term loan.

- Second, within the general cycle which affects us all, there are always pockets (e.g., industries, geographies, etc.) that defy the general cycle to some degree. For example, fast-food restaurants are largely resilient to recessions.

- Third, the dreaded “I-word.” Inflation is a fact of economic life, a side effect of growth and fiscal and monetary policies. Prolonged inflationary periods (a year or more of 3.5% or more, in my book) are among the most destructive forces societies face.

- Fourth, interest rates move up and down, affecting everything from the cost of a mortgage to the interest we earn on our saving accounts.

- And fifth, technological advances. While critical to productivity gains and economic prosperity, technological advances also create “winners” and “losers.” For example, the advent of digital photography put companies such as Polaroid, a former employer of mine, out of business.

There are other important factors, but I think this is a good place to start.

So, what’s a “resilient loan?” Resilient loans put both the borrower and the lender on the same side of the table: lending is NOT a zero-sum activity; both borrower and lender benefit from a good loan and are hurt by a bad loan.

There are four major components that come together to create a resilient loan: the underlying business, the loan itself, the business owner and the lender. I will skip discussing the underlying business and its owner for this write-up and come back to them in a future blog.

The Loan

Two quick disclaimers. First, I am only going to discuss loans to small and medium size businesses (SMBs) and loans ranging from $500,000 to say $12-15 million. In other words, our world. Second, my predisposition as a conservative lender will show.

- Fixed vs. variable rate: Contrary to common belief, a fixed rate is not safer. Sure, if you locked a rate at 2% you are a genius, but the reality is, we don’t know how high and how low a rate will change over the life of a loan. Increasing rates in a moderate-inflation world are typically the result of economic prosperity, and while your loan payment goes up, so should your revenue and profitability. Certainly, in a decreasing rate environment (i.e., now), you don’t want to be locked into a high-interest loan with expensive switching costs. If your ability to service debt changes from yes to no with a 2% rate change, you are borrowing too much.

- Amortizing vs. balloon: For the benefit of both borrower and lender, an amortizing loan is safer. The loan payment is higher, but there isn’t the cliff of refinancing to worry about. Does anyone know what the prevailing interest rates will be in five years? Seven years?

- Longest amortization possible: The benefit to the borrower is obvious; lower monthly payments which gives the business more free cash flow to reinvest. But it also provides better debt-coverage ratio which allows the banker to sleep at night.

- Moderate loan-to-value (LTV) ratio: We often compete on the basis of how much we can lend on any specific project and occasionally lose to lenders who advance more than we are comfortable providing. From experience spanning decades of lending and investing and closing thousands of loans, the high LTV loans are more likely to experience stress and failure for a host of reasons and to the detriment of both borrower and lender. What’s moderate: it depends, and largely driven by the debt-coverage ratio, not necessarily by how much equity was initially invested.

The Lender

One disclaimer; I am a lender.

- Smarts: If a lender is too lazy or dumb (yes, there are dumb lenders) and doesn’t take the time to understand the cash-generating abilities of your company, watch out. They aren’t looking out for you or themselves, just the quick fix that comes from booking a loan.

- Stability: An unstable lender is a careless lender, driven by the need to close loans, not necessarily closing good loans. You are married to that lender for the duration of the loan; do the research.

- Dedicated SMB lending team: Entrepreneur-led small and medium businesses have unique needs which must be understood by the lending team. That team will not only fund the loan, it will also be there with the borrower in tough times. Banks are mostly interested in deposit relationships; find one that’s foremost interested in lending.

- Regulated: I covered the topic of unregulated loans in last month’s blog which you can find here (https://gulfcoastsba.com/the-gilded-cage-the-perils-of-private-credit-for-small-businesses/). The takeaway should be to avoid unregulated loans/lenders.

In summary, a resilient loan combines a strong borrower, a robust loan structure, and an experienced lending institution dedicated to small business lending.

If you are looking for debt capital and would like to discuss how we stack up against these criteria, give our experienced team of professionals a call. You’ll find their full contact information here: https://gulfcoastsba.com/our-people/.

The Gilded Cage: The Perils of Private Credit for Small Businesses

In the past few weeks, I’ve been running across articles about emerging problems in the “private credit” markets. In essence, as the economy started exhibiting more strains (inflationary pressures, layoffs, and cratering consumer sentiment), several large businesses that were funded by private credit collapsed and raised the specter of “If you see one cockroach, there are a thousand more you don’t see.” You should definitely search “TCPC” if the topic interests you.

As a small-business lender, we are as far from Wall Street as it gets, but there are similarities worth exploring.

First, some definitions are necessary. For this essay, I equate Private Lending with Unregulated Lending and Private Lenders with Unregulated Lenders. For example, banks are highly regulated, and don’t fall into the Private Lender definition. On the other hand, merchant cash advance companies (“MCAs”), for example, are still largely unregulated and I refer to them as Private Lenders.

Second, let’s all agree that as traditional banks have tightened lending, private lenders have become go to alternatives for small businesses, and some of them do a good job. However, while private credit offers speed and flexibility, and in some cases is the loan-of-last-resort, its “bespoke” nature often masks predatory costs and control mechanisms that can suffocate small businesses.

What is the cost of the relative ease for accessing private debt, a/k/a “hard money?”

- While lenders often disguise the actual cost of private debt, it is significantly more expensive than bank debt, often equating to up to 20% or more APR.

- Origination fees (2%–5%) and the danger of Payment-in-Kind (PIK) features, which allow interest to roll into the principal, leading to a “debt snowball” effect.

- Common restrictions on owner draws (taking a salary), limits on taking other debt, or requiring approval for minor operational decisions.

- Because these lenders are less regulated, they may move faster to seize collateral or force a sale if a single quarterly metric is missed.

- Most regulated lenders will eschew paying off hard-money loans and in many cases would not lend to businesses that took such debt at all.

Most worrisome, what was meant to be a short-term, as a quick fix to a cashflow crunch, creates a “zombie” – meaning borrowers generating just enough cash to pay the interest but never enough to reinvest in growth or pay down the principal.

I urge small business owners to look at alternatives to unregulated loans.

- Both the Small Business Administration (SBA) and USDA have a variety of loans programs, some through banks, some direct, that focus on borrowers that can’t access conventional bank debt. Gulf Coast Small Business Lending, for example, offers SBA 7(a), 504, and lines of credit as well as USDA B&I loans that, in many cases, supplant the need for hard money.

- Equity investment, while typically more expensive than debt and comes with its own set of drawbacks, is in most cases a better solution than many of the private debt offerings.

- Banks (like ours) offer a variety of other loan products such as factoring, asset-based loans, equipment loans, secured and unsecured lines of credit, and purchase-order financing for cash-strapped companies. While the rates are invariably higher than SBA and USDA loans, they are largely devoid of the critical risks found in unregulated loan products.

True for all forms of loans and investments, but especially for the more opaque products, perform due diligence on the lender and have legal counsel study the paperwork.

If you are looking for capital and would like a value-added opinion from our experienced team of professionals, contact us (https://gulfcoastsba.com/our-people/) to discuss whether something in our toolbox of products fits your unique borrowing needs. More information can also be found on our website here: https://gulfcoastsba.com/sba-loans/ or in our Knowledge Center here: https://gulfcoastsba.com/resources/. Day in and day out we are finding a way to say YES!

The Role of SBA Loans In Strengthening the US Industrial Base

The recent interest in domestic manufacturing has struck a chord with me (and many others). When I was fresh out of college, I was hired by Polaroid (remember them?!?) to work on a technology-transfer project that brought a now-archaic production process from Yamagata, Japan to Boston. I spent a year in R&D, then moved to manufacturing to scale up the chemistry that ended up in one of Polaroid’s films. I left Polaroid in ’91 and, ever since graduating from business school, have spent the entirety of career in finance. But owing to that early experience, I have always loved, respected, and supported manufacturers.

I never bought into the idea that globalization and capitalism efficiently allocated resources nor that it was okay to rely on other countries to make and grow everything for us because of some theoretical “competitive advantage” that turned out to rely mostly on cheap labor and unfair trade practices.

So, I suppose it goes without saying that I wholeheartedly support the recent trend to reshoring and the US Small Business Administration’s (SBA) focus on manufacturing.

At Gulf Coast Small Business Lending, we provide SBA loans, both 7(a) term loans and lines of credit to the small business community who continue to be a critical component to all aspects of our economy. We have special interest in supporting these businesses, roughly along the following categories:

- Reshoring – financing efforts to expand domestic manufacturing to replace imported parts, components and finished goods. SBA loans can be used for equipment, plants, warehouses, and inventory, as well as general working capital.

- Specific industries – critical businesses are a high priority to our economy and our security and, as such, deserve the added support. Medical devices, aerospace, defense, and pharma are just a few examples. Again, SBA loans can be used to expand production with emphasis on capital expenditure.

- Modernizing legacy infrastructure – Manufacturing stateside never went away, but in many cases suffered from underinvestment and, in some cases, neglect. With the long amortization schedules and high advance rates offered through SBA loan programs, we are ideally suited to provide critical financing with the goal of bringing facilities up to date.

- Working capital cycles – Manufacturing rather than importing changes the operating cash cycle of a business, especially during the transition period. An SBA 7a loan can help clean up a balance sheet and together with a line of credit, offer additional liquidity.

- Supply-chain players – In many instances, small businesses provide parts, sub-components, and components to larger manufacturers. These businesses are of particular interest to us.

As a large nationwide SBA Preferred Lender, our experienced Gulf Coast Small Business Lending team is committed to supporting small businesses across many sectors and industries. As our economy pivots more towards manufacturing, we are delighted stand alongside America’s entrepreneurs to be a small part in strengthening the US industrial base and the long-term growth and competitiveness of American manufacturers.

If you are interested in more information or want to discuss a financing need, please reach out to me or one of our Gulf Coast Small Business Lending business development officers (contact information here: https://gulfcoastsba.com/our-people/). We are finding a way to say YES!

SBA Lending and The Big Short

In recent weeks Michael Burry, legendary short-seller and author of The Big Short came out swinging at the AI hyperscalers (Meta, Oracle, Microsoft, Amazon, and Google) and their suppliers (primarily Nvidia). In plain English, Burry is asserting that the hyperscalers are understating depreciation on their massive datacenters and thus pumping up their earnings; the equipment they are buying would be obsolete much faster than they are claiming and that in the very near term they will require far more capital expenditures, reducing their cash flow. They will also be forced to accelerate depreciation (or write-offs), driving down earnings. Enron redux.

What does that have to do with small business lending in general and SBA lending in particular?

Believe it or not, we worry about the same issue when we assess new loan requests; overestimation of cash flow and the ability (or inability) of borrowers to take on as much debt as they request.

When a loan request is presented to us, the initial spreads are typically derived by the borrower or broker based on someone’s calculation of EBITDA (Earnings before Interest, Taxes, Depreciation and Amortization) or Seller’s Discretionary Earnings (“SDE”) which also adds back one-time expenses and expenses that are associated with the seller’s management of the business and are considered “non-recurring.” The buyer is expected to pay a multiple of EBITDA or SDE and we are asked to provide debt to cover 80-90% of that amount.

However, we know that in addition to expenses, a business is also required to buy inventory, replace equipment, finance receivables and pay taxes, so we calculate what we term Free Cash Flow (“FCF”) which is always lower than what’s initially presented to us and may reduce the reasonable amount of debt the company should obtain.

Let me use an example of a loan we recently closed, financing the purchase of a FedEx route. By the way, we love financing FedEx routes, and the SBA 7(a) program is perfect for those businesses. Since the financials rarely talk about it, one of the first questions we ask is the age and condition of the trucks. Luckily there was ample cash flow and in this particular case we ascertained that the buyer would have to purchase two new trucks in the near future, and accommodated the request by adding a small line-of-credit to make sure that there is sufficient liquidity post-close to cover not only operating expenses but also the eventual purchase of the trucks. In other similar situations, we could not provide the debt requested and the loans were offered only after price reduction, seller-note and/or additional equity injections.

Here is my advice to entrepreneurs who come to us for capital to acquire a business (but really for any use of proceeds):

- The broker’s write-up and calculations of EBITDA/SDE is an excellent starting point to understand the business, estimate cash flow and even peg a price.

- Take it a step further and look at other near-term (2-3 years) cash needs, similar to what we will look at when we get the request:

- Equipment purchases and repairs,

- Inventory purchases,

- Growth of receivables as the business grows,

- Other anticipated cash needs such as taxes, rent escalation, and inflation that isn’t covered by price increases,

- A cushion for unanticipated uses of cash such as slower ramp-up, interest-rate increase, supply-chain disruptions, and loss of a major customer or an account,

- The needs escalate for fast growing/moderate margin businesses such as distributors and staffing companies.

- Using a very simple model, calculate the anticipated debt service on the loan requested and make sure that the actual cash flow covers it with some room for error. Share your findings with the seller and broker to get their point of view.

- Share your findings with the loan officer working on the deal; we put tremendous weight on your sober assessment of the opportunity.

I have no idea whether Burry is correct in his assessment of AI hyperscalers and their vendors. It seems reasonable. But unlike Burry, we aren’t in the short business; we take long positions on businesses we support. Paraphrasing a description of OpenAI founder Sam Altman, we are optimists yet survivalists, with a sense that things can go wrong. With the supporting loan guarantees provided to lenders like Gulf Coast Small Business Lending, the SBA 7(a) loan program is designed to assist entrepreneurs that cannot access traditional bank debt and we take that task seriously; help us by understanding the ability of the business to support our debt.

Gulf Coast Small Business Lending is among the nation’s leading SBA lenders. We are actively lending nationwide as SBA Preferred Lenders. Reach out to one of our business development officers (contact info here: https://gulfcoastsba.com/our-people/) or to me to help you with your next project. We work hard at finding a way to say YES!

Finding a Way to Say YES

For the past year or so our communications with the outside world have revolved around a simple message: “finding a way to say YES”. You have likely noticed that this catchy tagline appears in our announcements, mailers, tombstones, social media postings, and videos. We might even have t-shirts that feature it! The phrase came up, not as the result of deep thinking and countless hours of market research, but rather its origin owes to an utterance from our own Director of Marketing (Jenni Shover) during a conversation with our leadership team. She pressed us by pointing out that “don’t y’all always try really hard to find a way to say yes?” We realized that this one simple statement isn’t just aspirational, it is part of our culture.

Here we are a year later, and Jenni has asked me to write about the phrase; what it means and what it doesn’t mean to me, as our Gulf Coast Small Business Lending President & CEO. These are my thoughts on “finding a way to say YES!”:

So, what does it mean? In reality, it means exactly what it says: we are here to support entrepreneurs who wish to acquire a business; start a restaurant; clean up a balance sheet; buy out a partner; build a warehouse; and more. When our BDOs first see a potential deal, that’s what crosses their mind: “How do I get this deal done?” or, better said “How do we find a way to say YES?” The same attitude can be found in our credit department (although, admittedly, they might prefer it if we’d hedge just a bit more). As a loan moves through the process and spreadsheets get populated with new data, the financials usually take on a different flavor. But the attitude remains: “okay, the data is a little different, what do we do to get this deal done?” Same when it gets to packaging, closing, and servicing. We are driven and our processes align with our intent to say “yes” to and follow through with an LOI whenever possible. If there is a deal to be done, we will do our darnedest to make it happen.

What does it not mean? In practice, we don’t say “yes” to every single loan request. I’m fairly certain that everyone understands that that simply isn’t possible. There are many reasons why we sometimes cannot say “yes”: the business plan does not support the request; the SBA deems a loan ineligible; the borrower is seeking an advance rate that does not meet our own level of comfort; and others. When we run into an opportunity like this, our first reaction is to still try to find a way to convert a “no” to a “yes” by proposing a different structure or modifications to the request. In truth, this happens pretty regularly. Loan structuring is an iterative process, helped significantly by our decades of experience and our desire to provide financing, our structuring expertise, and the various financial tools at our disposal make this a likely outcome. If restructuring is not enough, we reach out to our network, both internal and external, to determine whether they can provide part or the entirety of a loan request. We try really hard to help even when we can’t be the “yes” they are seeking.

As an example, our parent bank also owns an order-financing company, something that is difficult to accomplish with just an SBA loan. When some loan proceeds go towards the purchase of inventory to support orders, we may pick up the phone, talk to our partners at Trade Cap and see if they can join in. When we run out of options, which sometimes happens, we make sure the customer understands why we could not assist. It is not uncommon for an entrepreneur to address an issue or two and return to us at a later date to re-consider.

“Finding a way to say YES” is a way of life here at Gulf Coast Small Business Lending and, in many ways, it’s what makes us unique. We are experienced SBA lenders actively approving deals all across the United States as SBA Preferred Lenders. Especially during these times, our stability and experience are more important than ever. Give your Gulf Coast Small Business Lending representative a call (https://gulfcoastsba.com/our-people/) to discuss your next SBA loan request, and we will quickly ascertain whether we are the right lender for your situation. We are finding a way to say YES!

And no, we don’t have a t-shirt with that slogan, but we are seriously considering them!

The Case for Moderation

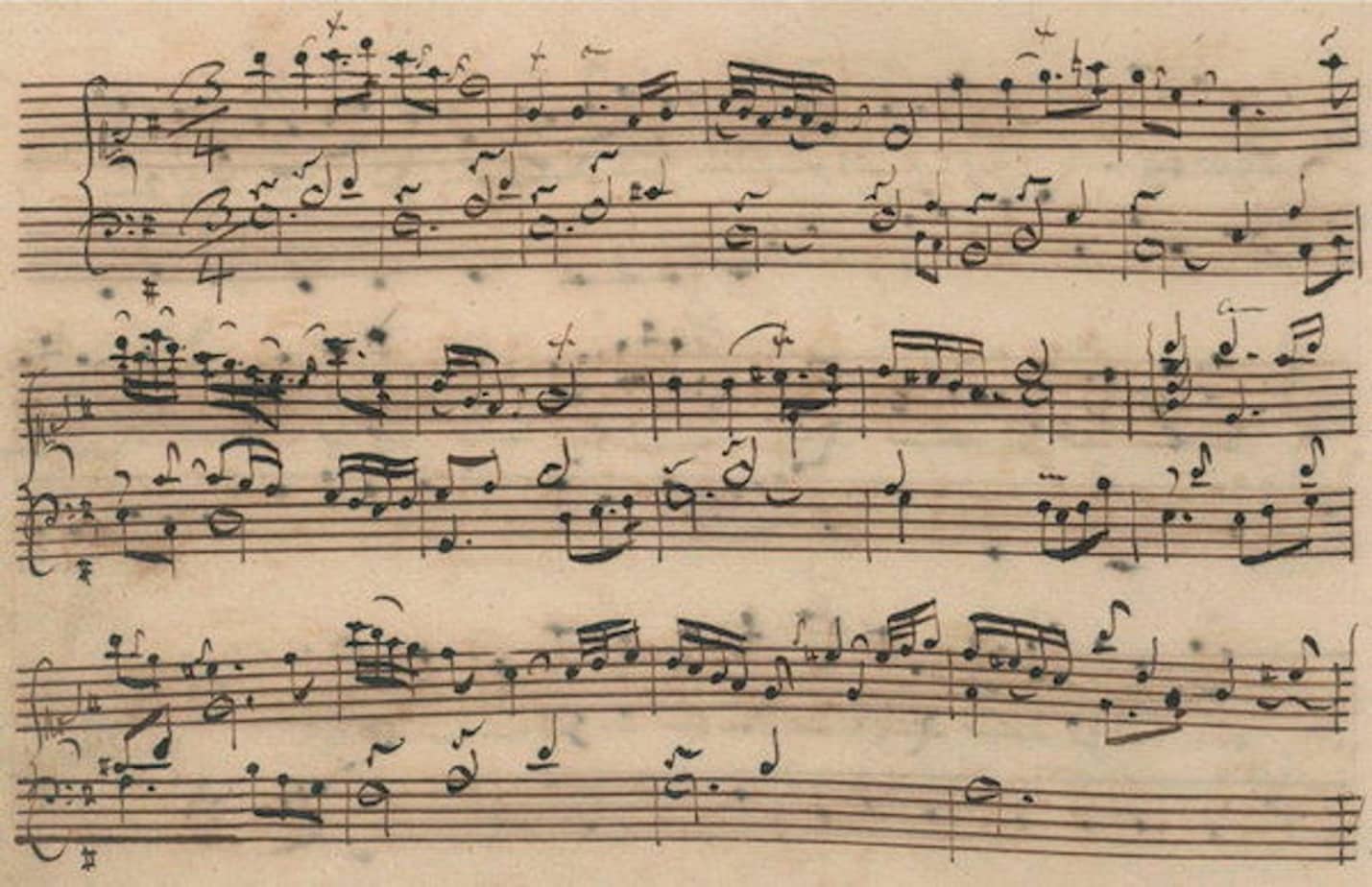

Last week was Glenn Gould’s birthday. The Canadian pianist’s career was launched in 1956 with his controversial interpretation of Bach’s Goldberg Variations: fast-paced, eschewing the signature repetitions, brash. The recording lasted just 39 minutes, easily fitting on an LP. Still, the recording is considered one of the most important milestones in classical music and made Gould an international star. Gould continued to forge his own style and in 1962, Leonard Bernstein, the then music director of the New York Philharmonic made history by prefacing Gould’s First Piano Concerto of Johannes Brahms, essentially saying “it’s not very good, WAY too fast, and I want nothing to do with it.”

Bach is my favorite composer and to celebrate Gould’s birthday I listened to his 1981 recording of The Goldberg Variations. Recorded a year before his untimely death, his approach to the masterpiece is completely different from the 1956 recording: measured, respectful, and introspective. This version lasts 51 minutes.

What does this have to do with SBA lending?

Our approach at Gulf Coast Small Business Lending reflects my taste in music, specifically what I like about the 1981 version. And, as importantly, we probably wouldn’t be a good SBA lender for a business modeled after the 1956 version. Allow me to explain.

Here is why high growth presents challenges to an SBA lender like Gulf Coast Small Business Lending:

- Free cash flow vs. EBITDA: EBITDA (or SDE) is interesting and important to some audiences, but not to lenders like us. Our credit decision is based simply on the business’ ability to repay our loan, and those payments come out of free cash flow (“FCF”), not EBITDA. Items like working capital changes and capex greatly affect the FCF and the amount of excess cash available to service our SBA loan and the gap between FCF and EBITDA grows rapidly when high growth is projected.

- Lender vs. Investor: Investors look for return on investment which is fueled by growth; lenders look for loan servicing ratios, which are sometimes reduced by growth, especially for sub-10% businesses (the majority of businesses out there).

- High-risk growth drivers: High growth situations we encounter, whether in business plans, acquisitions of existing businesses, or refinancings are often driven by unusual circumstances such as a very large new customer or contract; opening an Amazon distribution channel; or successfully exploiting a short-term supply-chain disruption. From a lender’s perspective, these are fleeting positive events that cannot be relied upon for future debt service.

My generic advice to SBA loan applicants, but even more so to high-growth borrowers, is multifaceted:

- Know your audience: Lenders have very specific criteria to decide whether or not to offer financing to potential borrowers; what advance rates to offer (e.g. how much can be advanced against a specific project); and what terms to provide (e.g. length, amortization schedule, and rates). Lenders are completely different from equity investors, and a presentation that works great for the latter might scare away the former. For example, hockey-stick revenue projections might attract equity investors because of the implied returns, but will scare the typical lender who, from experience, knows that working capital needs would severely limit debt-repayment abilities. To make things even more complex, all lenders are not the same. Many look for collateral, others, like us, are far more interested in the cash flow.

- Do your homework: Knowing that the lender is most interested in understanding the business’ ability to repay the loan, provide the financial information that addresses that aspect of the analysis. That requires taking the model beyond Adj. EBITDA, layering changes in working capital, and expected capital expenditures. The more granular the analysis, the more confidence the lender will have in the model, and the greater chance you have to get a credible term-sheet.

- It’s all about liquidity: This item is very specific to our shop and our products (SBA 7a, 504, USDA B&I, and franchise finance). Other lenders may not care/know. By far the most important aspect of our loan underwriting is determining the liquidity of the business at any point in the past, present and future and making sure that our financing provides ample flexibility to address foreseen as well as surprise ups and downs in available cash. In other words: we really don’t want you to run out of money…to accomplish that, we first strive to understand the operating cycle (see item #2 above). We then run sensitivity analysis to show how the cycle changes as major variables are flexed and what happens to the cash position of the business. Finally, to address any shortfalls we examine the size of the loan, the borrower’s post-transaction personal liquidity, and finally the possibility of adding a line of credit as an extra safety measure.

In summary. Growth is good, growth gets the blood pumping, and it is something many of us are after. But it also complicates debt financing. We provide capital to many growth companies using the tools and knowledge we have and would love to discuss your project with you.

Gulf Coast Small Business Lending is a direct SBA Preferred Lender actively financing small businesses nationwide. If you have a question or a comment about anything here, or if you want to run a deal by us, drop me a message or reach out to one of our BDOs (https://gulfcoastsba.com/our-people/).

It’s Not That Hard, But…

Our A/C broke back in May, which in the balmy Texas summer is, well, unpleasant to say the least. To their credit, the HVAC guys (Zach and Jose) showed up quickly and addressed the issue, which turned out to be an overloaded old breaker. Growing up, I spent most of my summers and breaks with my grandfather who was an electrician, and I am actually good with my hands and generally understand how things work. But A/C eludes me. I chatted up the guys: “How hard is your job?” Their prophetic response: “It’s not hard, but you gotta know what you are doing.”

It struck a chord.

I’ve been travelling a lot these past six months, meeting with and presenting to potential borrowers, brokers, bankers, and many of the intermediaries we work with to get loans in the pipeline and, ultimately, closed. The content of my presentation is straight forward: (a) who we are, (b) what we do, (c) how we can help, and (d) Q&A. The presentation, however, evolved over those months and now the Q&A section takes up the majority of the time. It turns out there are many questions and misconceptions about the SBA program, specifically the SBA 7(a), and the most effective use of our time is addressing those. And since May I begin each presentation with “It’s not hard, but you gotta know what you are doing.”

Here are the top three comments/questions that come up and a very quick summary of my answers, which, by the way, are very specific to how wedo SBA loans and may not apply to other lenders.

“It takes forever to close an SBA loan.” It shouldn’t. We typically close a 10-year loan inside four weeks, a real estate one a little longer, from the time we have a full package. Getting the package to the “full” status is driven in large part by our team, but we can’t do it without the borrower. Borrowers are provided a checklist as soon as they return our LOI and we collaborate diligently with them and their accountant (if applicable) as well as the broker to get the documents in as soon as possible. Once a package is complete, it is submitted to one of our underwriters who completes a comprehensive analysis in just a few days, interacting with the borrower when questions arise. The underwriter then submits a recommendation to our internal team (we, meaning me + one or two other divisional teammates, have the credit approval authority for upwards of 95% of all deals we see), which convenes daily (frankly one of my favorite activities on any given day!). Once approved, a Commitment Letter is issued and the loan heads to closing. Like borrowers and all deal parties, we want to fund loans as soon as possible while making sure we are doing it the right way for everyone’s protection. A quick pro-tip: one of the items that always appears on our Term Sheet is SBA’s requirement for life insurance. It’s a simple step, but we can’t close a loan without it, so please start (we can help direct you to some terrific providers with knowledge of SBA requirements) on that as soon as practical because it sometimes takes longer than expected.

“SBA loans are really complicated.” Absolutely true. Yet, tens of thousands of business owners take advantage of the programs annually and consume in excess of $40 billion in loan proceeds to acquire and refinance businesses, to invest in equipment and real estate and to start new ventures. The key is to work with the right lender: one with a track record of closing many SBA loans, ideally complicated ones, and one with dedicated in-house credit, closing, and servicing staff. One with years of specific SBA industry experience. If you work with a broker, your first question when she or he presents potential lenders should be “have you closed loans with them before?” And when you get on the phone with the prospective lender for the first time, interview them to make sure there is a fit and they have the experience and track-record with their current bank. I truly can’t understate the importance of this.

“All SBA lenders are the same, and I will choose the one with the lowest rate.” In some (rare) instances, that’s true as well, but in 99% of the cases, the lowest rate presented on a term sheet is just one (and not the most important) factor a borrower needs to consider when deciding who the right lender is. The range you will see on any one loan is +/- 1% or less. Would you pick your surgeon based on whether the co-pay is $100 or $120? As stated earlier, dig into the experience of the lender and their track record closing SBA loans. The broker, if you use one, is indispensable in determining that, as well as your own level of comfort with the banker you speak with. Ask around, it is an important decision.

Circling back to what my A/C guys said, with a twist: “It’s not hard, but your banker has gotta know what they are doing.”

If you have a question or a comment about anything here, or if you want to run a deal by us, drop me a message or reach out to one of our BDOs. You’ll find their contact information here: https://gulfcoastsba.com/our-people/. We have the experience, we know what we’re doing, and we are finding a way to say YES!