Not the weather.

As I write this, snow is falling, and the temperature is somewhere in the teens. Fahrenheit. I keep my weather app on Celsius because I speak to my mom (who lives overseas) every morning and she always asks how the weather is.

But I digress.

As many of you know, I am a little obsessed with economics and current affairs, and it has certainly been a task keeping up with all the news and developments as of late!

So first, the news. On Thursday February 20th, the Senate confirmed former Sen. Kelly Loeffler, R-Ga., as Administrator of the Small Business Administration (SBA). We are delighted to have her as the leader of such an important agency of the federal government and, speaking on behalf of the sixty of us working at Gulf Coast Small Business Lending, we look forward to continuing our work with SBA’s D.C. headquarters and regional SBA (and USDA) offices across the country.

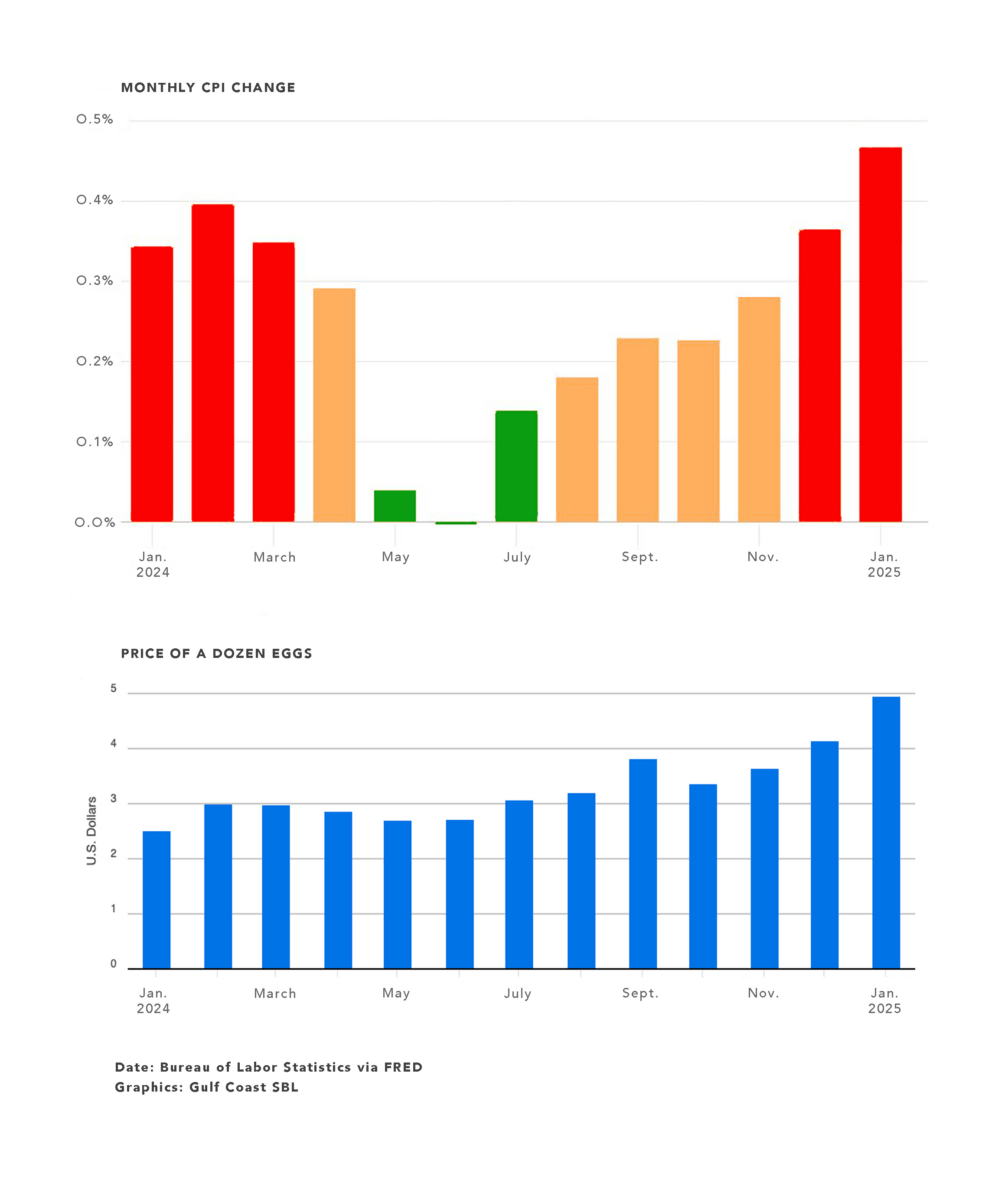

Now back to the heat. Of all the economic news out there, I am currently fixated on inflation. A quick definition first: inflation refers to the rate of change (increase) of the price of a basket of goods, not the actual level. And the most popular measure of inflation is the Consumer Price Index (“CPI”) which is published monthly and closely followed by numerous constituents.

After appearing to have been tamed last year, inflation is rearing its head again. Last week, CPI clocked in at a monthly increase of 0.5%, 3 percent annualized. The Federal Reserve seeks to achieve inflation at the rate of 2 percent over the longer run as measured by the annual change in the price index for personal consumption expenditures. Many products have risen in price; for example, the price of a dozen eggs has doubled since a year ago.

The most immediate implication, one that is especially important to our borrowers (and, therefore, to us), is that interest rates will not be further reduced in the short term. I am anticipating, at most, one small cut (0.25%) in 2025 and, perhaps, two in 2026.

Without question, inflation is the most corrosive force in economics, eroding purchasing power and destroying savings. The Fed understands that and many years ago made inflation containment one of its two imperatives (the other being unemployment). I have full faith in the Fed’s ability to bring down inflation again, probably in a “soft-landing” manner, and hope that the close historical relationship with Treasury continues.

But it will take time. Our economy is a big ship, generally headed in the right direction, and now in need of a course correction. As we anticipate the return to normal price levels, our Gulf Coast Small Business Lending team continues to support America’s small businesses by providing SBA loans to acquire, grow, refinance old debt, and invest in the future.

If you’d like to discuss your borrowing needs or talk about the economy – please reach out. You can find contact information for our experienced team of SBA lending professionals here: https://gulfcoastsba.com/our-people/.