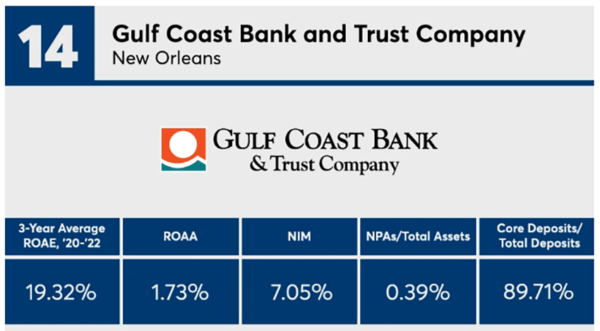

I’m really pleased to share that in American Banker’s annual ranking of the 200 top-performing banks sized $2 billion to $10 billion by assets, our parent bank (Gulf Coast Bank and Trust Company) was ranked number 14 in the country. Among other factors, these rankings were determined by considering the banks’ ROAA, ROAE, NIM, NPA/total assets percentage, and core deposits/total deposits percentage. You can review complete details in American Banker’s article “Profitability Rests on Strong Asset Quality,” published Monday, June 19th.

Although you may be familiar with our SBA lending division, you may not know that Gulf Coast Small Business Lending is part of a family of 19 financial service businesses across the United States collectively owned by Gulf Coast Bank and Trust Company. Our SBA group (Gulf Coast Small Business Lending) is proud to be a division of Gulf Coast Bank and Trust Company.

The President & CEO of Gulf Coast Bank and Trust Company, Guy Williams, had this to say in the opening letter of the Bank’s 2022 annual report (https://gulfbankannualreport.com/2022/#gcb-annualreport/01):

“Looking back at 2022 and considering the future of the banking industry, it is important to reflect on where we have been and are going. Last year, we had our best earnings, making $65 million, and expanded our footprint by acquiring a major leasing company in Minnesota. This acquisition will allow us to offer commercial leasing to our customers in Louisiana and throughout the United States.

However, for some peers in the industry, investing in long-term fixed-rate investment securities and long-term fixed-rate mortgages became problematic when interest rates rapidly increased to combat inflation. This resulted in a few banks going bankrupt due to the loss in value of their investment portfolios.

Fortunately, our bank did not invest our deposits in long-term loans or securities. We balance our books to have minimal interest rate risk. This is simply good banking.

Because we are both well capitalized and in balance concerning interest rate risk, we are able to support our customers with new loans while acting as a safe and sound place to make new deposits. As a result, we expect to continue growing this year and have possible opportunities for additional acquisitions.”

Our SBA lending division and, in turn, our borrowers, employees, and intermediaries benefit from being part of the Gulf Coast Bank and Trust family of companies. When the bank, as a whole, is performing well it allows us to focus on what we do best – the superior delivery of SBA 7a loans nationwide. Working with entrepreneurs to help them achieve their dreams is our passion. When we say “good things are happening at Gulf Coast Small Business Lending”, this is what we mean. We remain bullish about SBA lending and we have the support of our parent bank to pursue and deliver this singular focus. And that is why I borrowed a quote from Guy Williams to use as the title of this blog “the road we travel together will be prosperous”.